Are You Spending Money to Keep Stuff You Don’t Need?

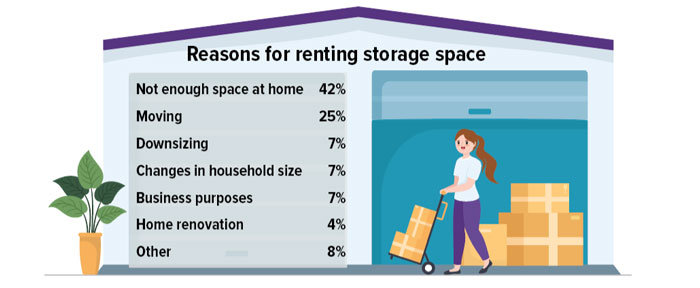

It’s estimated that almost one in five Americans leases a storage unit. In March 2024, the nationwide price for a climate-controlled storage unit averaged nearly $150 per month. Storage renters may pay more than that for large spaces and at facilities in high-cost cities such as Los Angeles and New York.1

If you keep excess belongings stored away from home and well out of sight, this recurring monthly expense may not stay top of mind. However, finding the motivation to empty a storage space could create breathing room in your household budget and/or yield savings over time that helps you make progress toward important financial goals. For example, if you were to invest that $150 per month in a college savings or retirement account, the balance could grow to $25,963 in 10 years or to $78,139 in 20 years (assuming a hypothetical 7% annual rate of return).

It may not be your favorite way to spend a weekend but decluttering the closets, garage, and living spaces in your home would be a good place to start. Prioritize and make room for the possessions and keepsakes you love most but resolve to let go of things that may not be worth keeping, especially if you must pay for storage indefinitely. Try to sell furnishings, housewares, toys, or clothing that you don’t use regularly for some extra cash by posting ads with photos on resale apps, websites, or social media, or possibly by having a yard sale. If you can’t sell certain items, you can feel good about giving them away to friends, neighbors, or a local charity.

Source: StorageCafe.com, March 2024

This hypothetical example of mathematical principles is used for illustrative purposes only and does not represent the performance of any specific investment. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Actual results will vary. Rates of return will vary over time, particularly for long-term investments.